The impact of climate change is becoming more intense year by year, which we believe will affect the growth of our business activities over the short, medium, and long term. We will promote business and other activities for the social implementation of sustainability and will endeavor to reduce greenhouse gas emissions and environmental burden. These include the businesses to streamline operations and improve marketing efficiency, utilizing digital technologies.

Disclosure based on TCFD recommendations

In February 2023, the ORO Group announced its support for the Recommendations of the Task Force on Climate-related Financial Disclosures (TCFD*) (the “TCFD recommendations”).

* TCFD is an international initiative, established in 2015 by the Financial Stability Board (FSB) at the request of the G20, for the purpose of encouraging companies to disclose information related to the financial impact of risks and opportunities brought by climate change on their businesses.

The ORO Group believes that it can contribute to the sustainable development of society and the medium- to long-term improvement of its corporate value by identifying climate-related risks and opportunities in line with the TCFD recommendations and then enhancing its climate change-related initiatives and information disclosure.

Climate change-related scenario analysis

The ORO Group analyzed climate change-related risks in accordance with the TCFD recommendations. Specifically, we determined risks and opportunities and quantified their impact on ORO Group under the following two scenarios: a 2°C or lower scenario, in which the world keeps the rise in the global average temperature at 2°C or lower by 2100 along with sustainable development; and a 4°C scenario, in which the world fails to implement additional mitigation measures, and as a result, the global average temperature rises 4°C by 2100.

Going forward, the Group will assess the financial impact of climate change-related risks, and will endeavor to mitigate the risks by implementing countermeasures in the order of priority based on the magnitude of their impact. The Group also aims to contribute to realizing sustainable society and achieve its sustainable growth as an enterprise by making use of business opportunities brought by climate change.

* In our analysis, we refer to the following scenarios and others.

IEA (International Energy Agency) World Energy Outlook 2018 Sustainable /

IEA Energy Technology Perspectives 2017 Beyond 2℃ Scenario (B2DS) / IPCC (Intergovernmental Panel on Climate Change) Fifth and Sixth Assessment Reports: RCP8.5, RCP6.0, RCP4.5, RCP2.6

2°C or lower scenario

| Risks and Opportunities |

Impact on ORO Group |

|---|---|

| Business opportunities |

|

| Business opportunities |

|

| Business opportunities |

|

| Transition risks |

|

| Transition risks |

|

| Transition risks |

|

| Transition risks |

|

*1 Transition risk refers to the business and financial risks that companies face in transitioning to a low (de)carbon society. Assuming the introduction of laws and regulations, technological innovation, and changes in market preferences, transition risks are further classified into four categories: policy and regulation, technology, market, and reputation.

4°C scenario

| Risks and Opportunities |

Impact on ORO Group |

|---|---|

| Business opportunities |

|

| Business opportunities |

|

| Physical risks |

|

| Physical risks |

|

*2 A risk that materializes in the wake of natural and other disasters triggered by climate change is called a physical risk. Physical risks can be classified broadly into the following two: “Acute” risks that are caused by specific climate events, and “Chronic” risks that are caused by changes in climate patterns over time. Sudden climate events, such as heavy rainfall, floods, storm surges, droughts, wildfires, could have a negative financial impact on a company.

Greenhouse gas emissions (GHG Emissions)

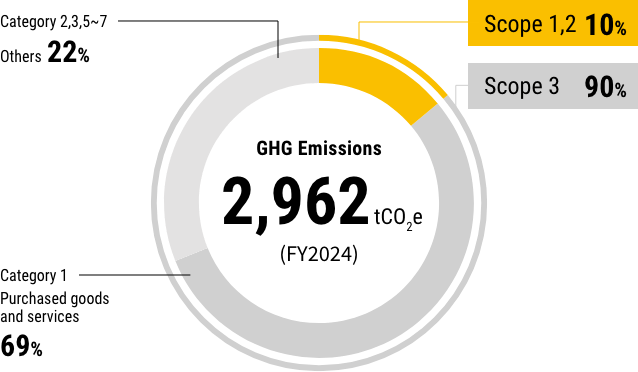

As a result of the analysis above, we have concluded that, to promote the ORO Group’s corporate activities sustainably and smoothly, we need to contribute to climate change-related initiatives under the 2°C or lower scenario. As part of the efforts to push forward with such initiatives, we have set the GHG emissions reduction targets based on the level of our current GHG emissions.

Assessing the current status of greenhouse gas (GHG) emissions

The Group’s GHG emissions for the fiscal year ended December 31, 2023 came in at 2,449tCO₂e.

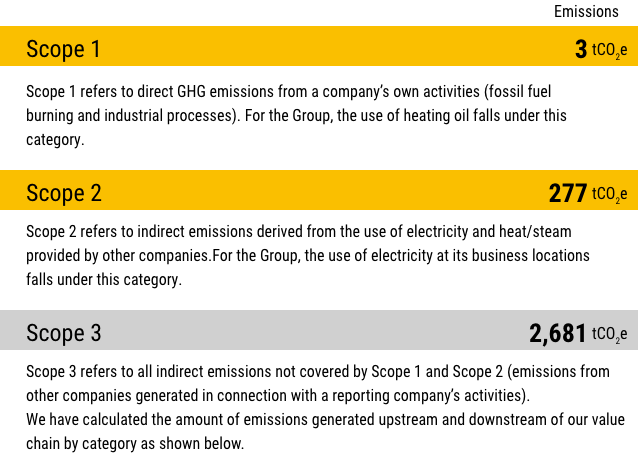

We believe we can reduce the emissions under Scope 1 and 2 through our own efforts as they are direct emissions plus indirect emissions from the use of electricity by the company.

Metrics and targets

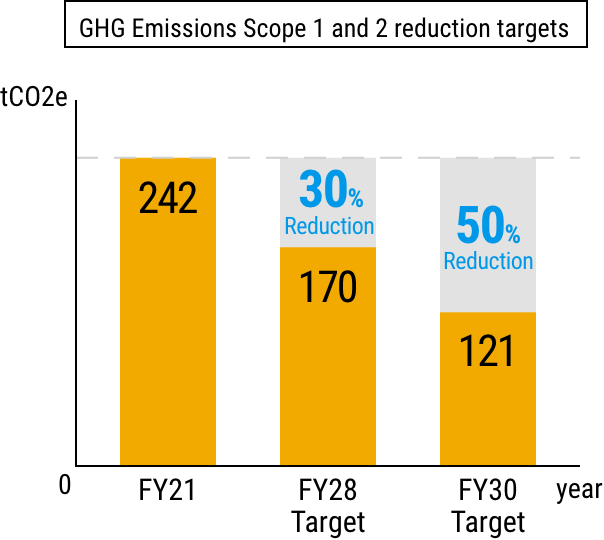

The ORO Group has set targets to reduce greenhouse gas (GHG) emissions (Scopes 1 and 2) by 50% from the 2021 level by 2030. The Group has also set a medium-term target to reduce GHG emissions by 30% from the 2021 level by 2028.

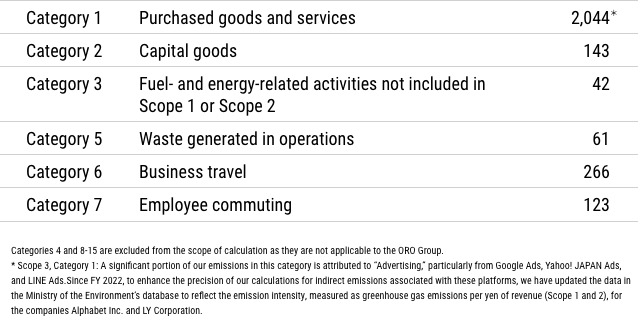

Most of our emissions that fall under Scope 3 are associated with web advertisements we have commissioned from and run on behalf of our customers in the Digital Transformation Business. Therefore, the amount of GHG emissions is projected to increase in line with the growth of this business.

For this reason, we have set our emissions reduction targets only for Scope 1 and Scope 2.